THE INFLATION FEAR

May 19, 2021

In the last decades, interest rates have only shown one direction – alongside inflation rates they have moved south. Until they tipped the bottom at zero or even in negative figures.

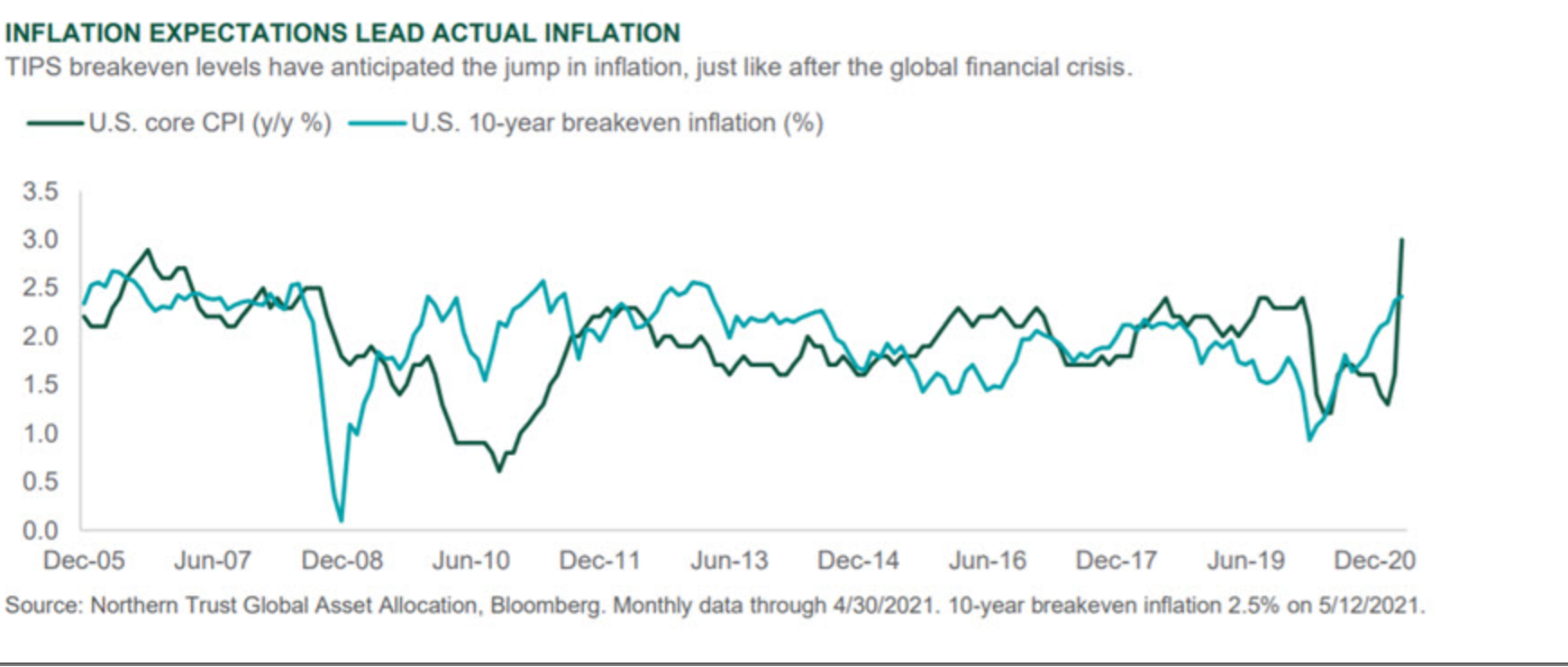

Now for the first time, inflation is on the screen again with prices in some commodities picking up and financial markets have started to respectfully react to inflation fears.

Here are some arguments for investors that foster inflation:

- Inflation was never gone, really. It just was not visible anymore, as it moved on to real assets like real estate and private equity. Here prices went up substantially, but these assets are hardly accounted for in the normal indicators we use to measure inflation.

- The excess liquidity central banks provided did not trigger inflation in other segments, even though - according to economic textbooks - it should have: whenever money supply grows more than the economy, ‘ceteris paribus = other things being equal’ prices should rise. This did not happen because the circulation velocity of money went down about as much as money supply increased. Other things were not equal and this reflects also the flow of funds into real assets, which are longer-term by nature.

- The aftermath of the pandemic could well see ¨several industries working at capacity ¨commodities entering a short but buoyant cycle ¨increased cost of transportation ¨repatriation of parts of the production for medical supply at higher prices to the industrialized countries ¨less competition in some sectors after a shake-out and ¨competitive devaluations for an export boost. Cost price inflation, capacity-driven inflation and imported inflation come to mind, as well as the old wage-price spiral with more governments in the mood for higher wages and social benefits.

- Inflation is always in the interest of the debtor, so governments should love it, as it helps to reduce the public debt burden over time.

But investors should also think about counter-arguments:

- For governments it is not really the level of inflation, that matters. Instead, it is the negative balance of inflation minus interest rate. Financial repression is what we call this confiscation through the backdoor. And it can be powerful: The US managed to get rid of its heavy debt load after World War II successfully with financial repression from the 1950ies to the 1980ies.

- The financial burden of the pandemic will dampen the economic upturn for some years to come, thus limiting the inflation potential. In the Eurozone some countries could not persist with higher interest rates for their public debt, so the ECB will do anything allowed for by its mandate to keep rates from rising too much.

- Many of the sectors especially hit by COVID show little barriers to entry, so competition will pick up quickly. Think of tourism, events, entertainment.

- Competitive devaluations can easily be arranged by governments that control the exchange rate. Countries with floating exchange rates can only try to talk the external value of their currency towards the level desired. Countries that control the exchange rate directly often run export-oriented economies. Some -like China- increasingly have to watch their imports, too. And when purchasing local currency government bonds in the industrialized countries, an extremely high exchange rate gives them a bad entry and partially offsets their gains in foreign trade. So there seem to be reasonable boundaries for exchange rate fluctuations.

Investors should follow some basic rules:

- Keep little cash and bonds. Focus on linkers and floating rate notes, when prices are acceptable. The price of these securities will not automatically fall when interest rates rise, as their yields will rise in due course, too.

- Real estate is supposed to be an inflation hedge long-term. But after the excellent real estate markets we have seen, the hedge is likely to work for higher inflation rates only. With limited inflation, bond market mechanics could kick in: rising interest rates trigger lower prices/values. So, either real estate is a strategic long-term holding in your asset allocation or you focus on development and short-term trade sales. Anything in between could be dangerous.

- Public and private equity is also often seen as an inflation hedge. But again, this is medium to long-term. Once inflation takes off, usually a PE-compression is triggered, driving prices/valuations down. This means a downward adjustment in the earnings of companies leads to higher price-earning-ratios which in course triggers a correction of stock prices. In the next phase, markets will make a difference between business models and prefer companies or sectors with low level of fixed assets, short production cycles and sound financing. These should be able to benefit, as they can pass on higher prices to their clients immediately. Some even manage to improve their margins, raising prices more than cost goes up.

- Commodities seem to be an obvious inflation bet, but be careful: the current price move may be short-lived. There are too many factors that influence commodity prices and not even insiders manage their predictions always well. Only limited exposure seems to be wise here.

To sum it up: there is no need to panic. A reasonably higher inflation could be positive for the economy and for the fixed income market. Extreme inflation does not seem very likely. But some thoughts on your strategic asset allocation from an inflation point of view could be appropriate. Tactical moves on a sub-asset class level are recommended as mentioned above.

But work and investment should be fun also, so think about this: the money you spend today for a good purpose and an enjoyable life will not be exposed to inflation in the future!

DOWNLOAD OUR WEALTH ROBUSTNESS INDICATOR FOR FREE!

Take a closer look inside the exclusive Next Gen Masterclass program helping you manage, secure and transfer wealth effectively.

We hate SPAM. We will never sell your information, for any reason.